Features

Fraud checks

FrankieOne provides the following solutions that customers can use to prevent fraud when using both Onboarding Fraud Checks and Activity Monitoring.

Email check

Assesses whether the email is disposable, numeric, contains similarities to the user’s name, how old it is, how risky the domain is, and its general risk in our fraud provider networks.

Phone check

Assesses whether the number is associated with a risky line type like VOIP (Voice over Internet Protocol), the risk of the carrier, whether the phone name matches the user's profile with their telco, or if it is reported as fraudulent.

Device check

Device signals

Identifies devices via cookies and device fingerprinting. Based on the data gathered, we can effectively flag suspicious devices (emulators/scripts) and sessions (proxies / remote desktops) typically used to create synthetic accounts. We can assess whether multiple customers are associated with a device or IP address to form an understanding of relationships between sessions.

Behavioural biometrics

Assesses unusual mouse and typing activity that detects fraudsters via their intrinsic behaviour. For example, fraudsters are 30x more likely to copy/paste bank details, less likely to hesitate when pasting values, and more likely to use advanced shortcuts and straight-line mouse movements.

Location check

Assesses whether the user is located where they say they are, is using a VPN, or is in a high-risk location.

Note on OneSDK integration

OneSDK integration is required to receive fraud signals for location and behaviour on a device.

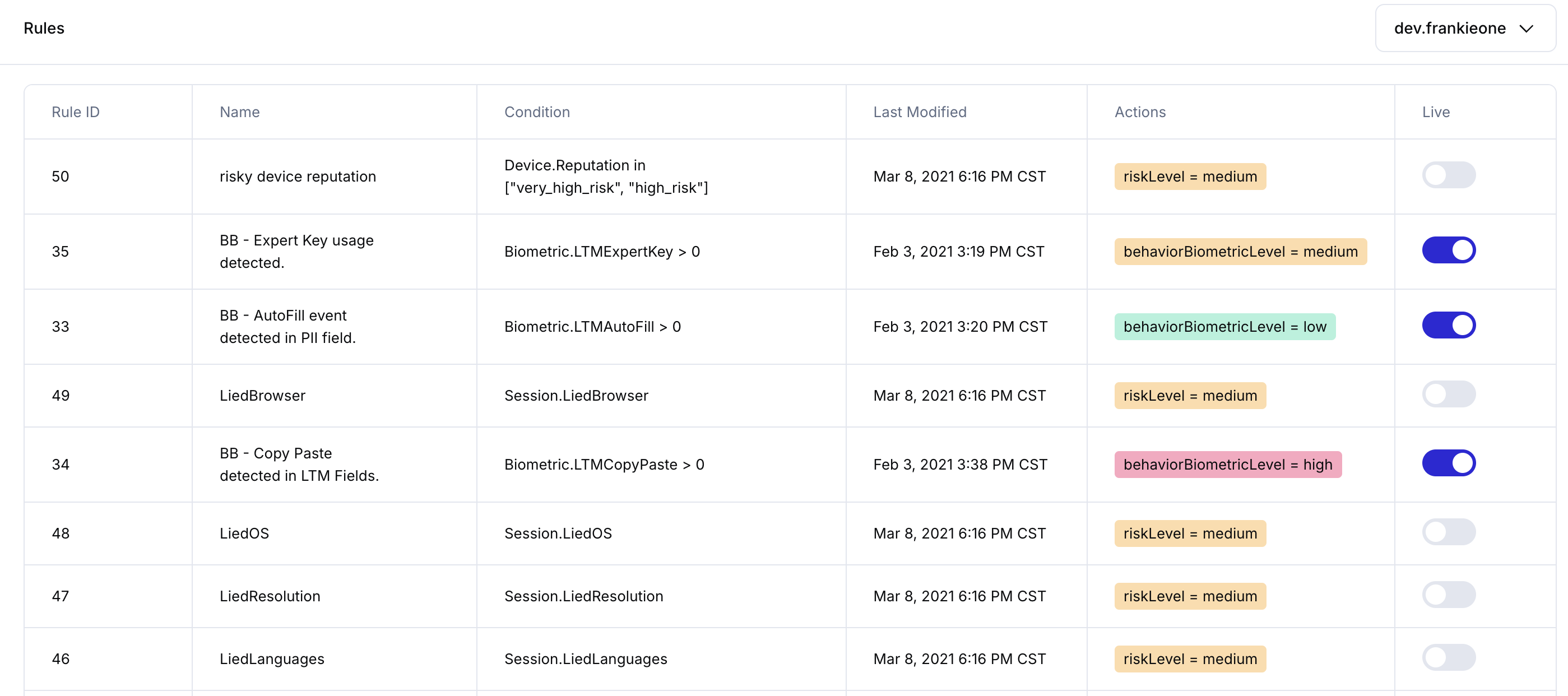

Rules

Creating rules

We provide a risk rule engine for you to use that is extremely versatile, and allows you to create rules using a huge range of user, phone, email, device, and location signals.

Shadow mode

If a rule is in Shadow mode, that means it will “execute”, but it will not update the risk level of a session. Running rules in Shadow mode initially is an easy way to start to get additional data about each session and experiment with what risk signals are most associated with fraud.

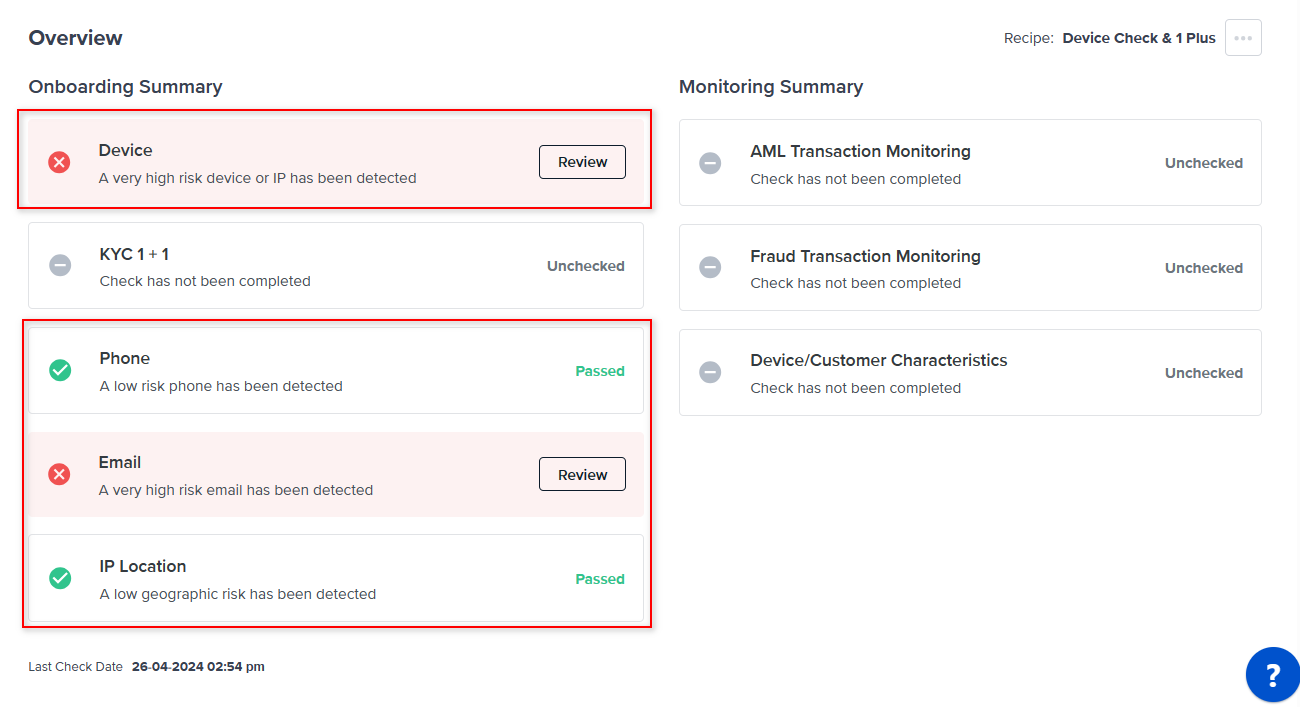

Results in the Portal

In the Portal, you can view fraud check results alongside your KYC and KYB checks in a single view.

Entity Status

When you have one or more rules in Live mode that are fired during a user session, the entity status in the Portal will reflect the highest risk found across your fraud checks. If one of the checks (email, phone, device, and others) returns a high risk or very high risk, the check status will be Failed, and subsequently, the Entity status will Fail.

When your rules are all in Shadow mode, they will not affect the Entity Status, however, you will still be able to see which rules have been executed in our provider's dashboard.

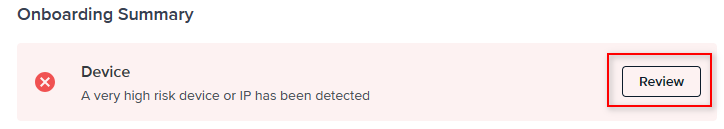

When a user is run through a recipe with account creation fraud checks, and it fails for any reason, you can see the specific risks associated with the failure on the overview page.

To view the details of any check that had risks detected, select the Review button.

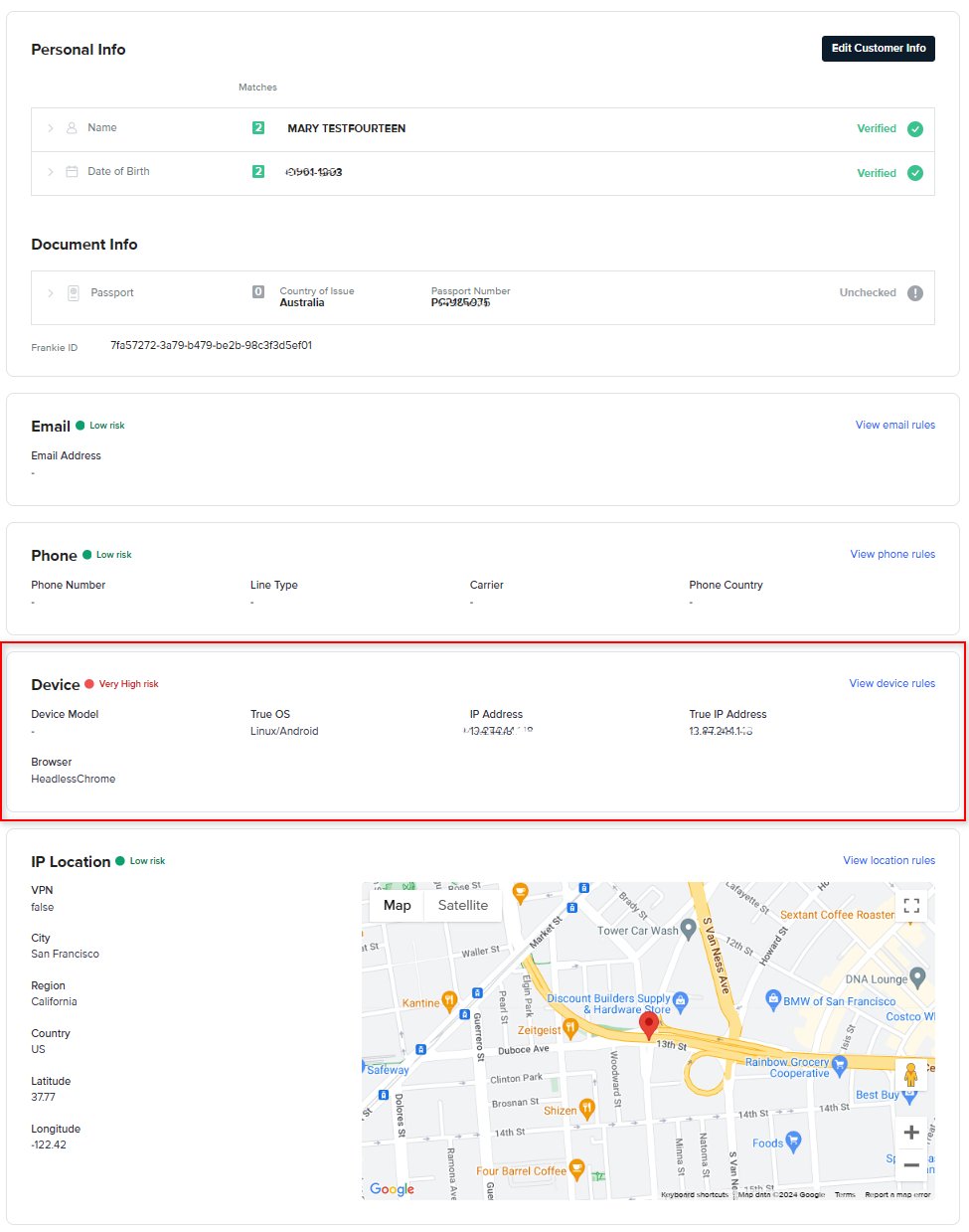

Alternatively, you can access the Personal Info tab and view the check result details.

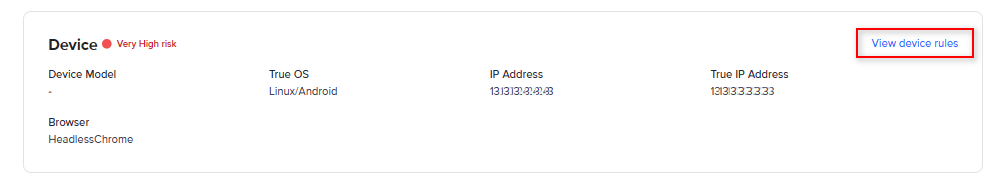

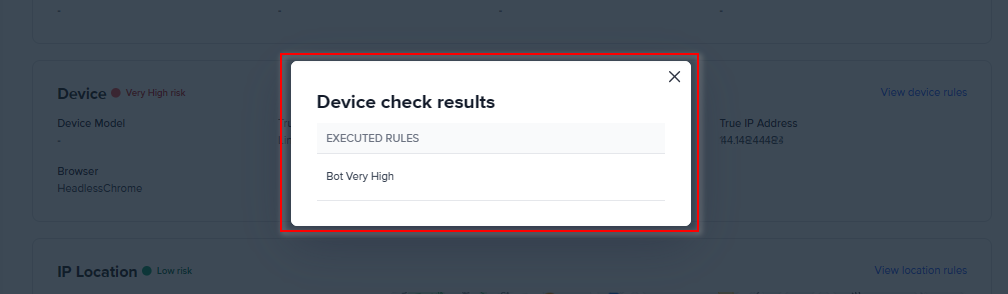

Each check results summary provides an overview of the information checked, and issues detected. There is also a link to display the rules that were applied to that specific check.

For example, for the Device check results, you can select the View device rules link to display the rules that were run as part of the recipe and rulesets.

Device and Customer Characteristics issues

For device and customer characteristics issues, open the Device/Customer Characteristics tab.

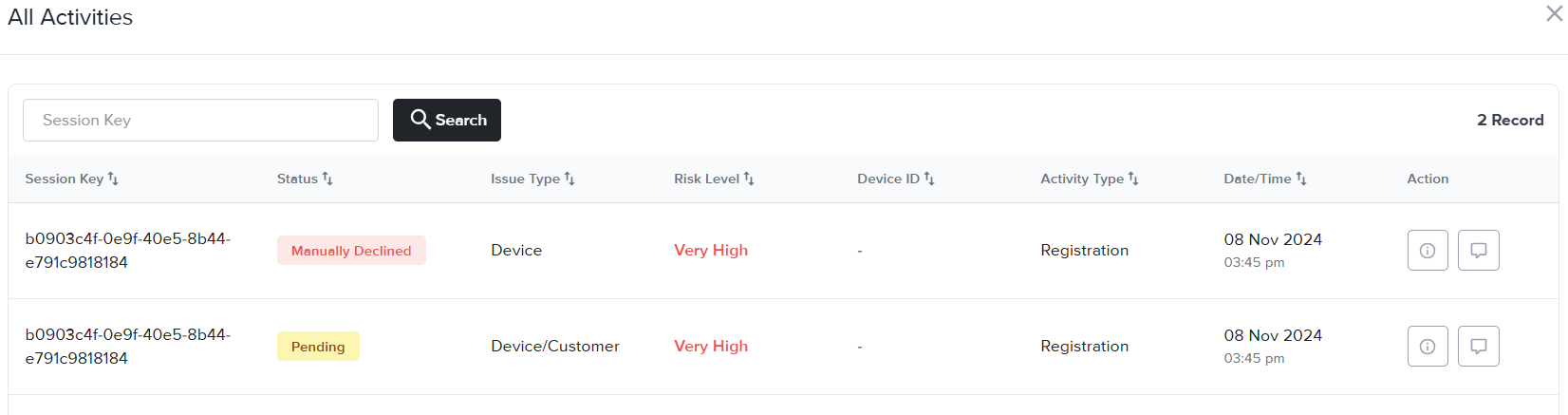

Issues that need resolutions are listed under the Needs Attention section. These issues have Pending

If there are many issues found, you can search through them using a specific session key. Just enter the session key in the Session Key search field.

To see more information about the activities that have been flagged, select the Information button on the activity's row. This links to our partner provider's site.

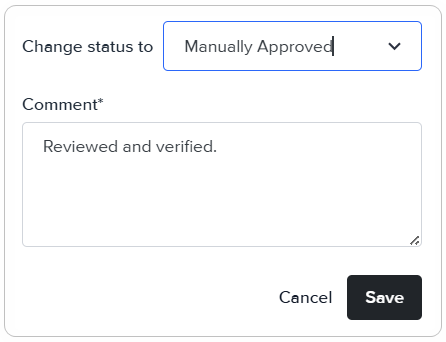

To update the activity with a comment and change its status, select the Comment button. This opens a modal where you enter your comment, and optionally, change the status.

Enter the comment, and change the status. Once done, select Save. The Needs Attention list will be updated.

If you changed the status to Manually Approved or Manually Failed, the issue will be removed from the list, but will still be available for review in the All Activities section. To view all activities, select the View All Activities.

Bulk update

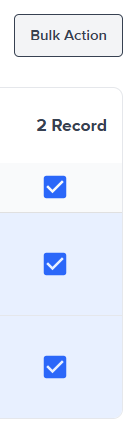

You can update and add comments to multiple issues. Select the tick box for the issues you want to include in the bulk action, then select Bulk Action.

The Bulk Actionmodal opens.

Select the status and add the comment for performing the bulk update. Once done, acknowledge that you're resolving all the selected records.

Select Confirm to apply the bulk action.

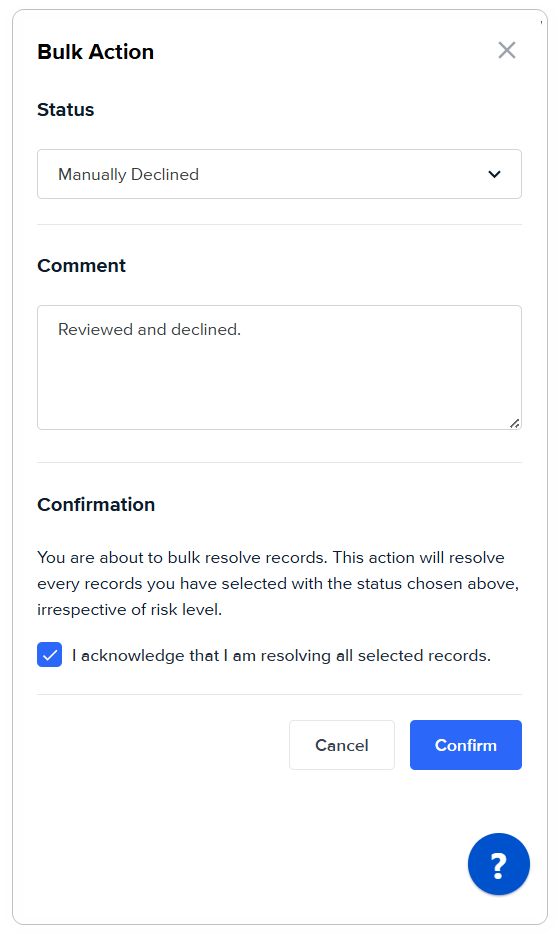

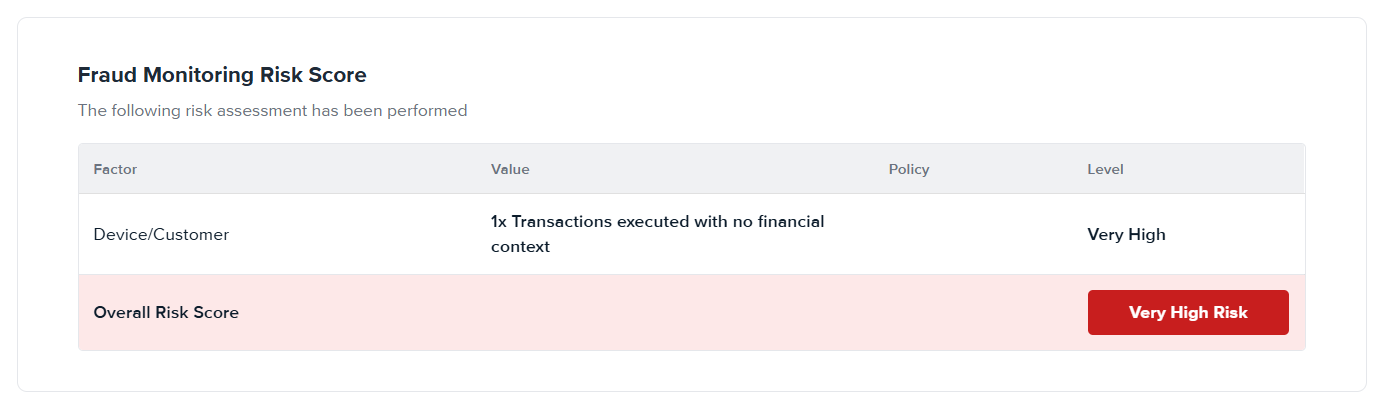

Risk Score

You can view the fraud monitoring risk score information under the Risk Score tab of the entity page.

In this tab, all the factors that contributed to the entity's risk score are listed.

You can manually override this risk score if you have enough basis for doing so. Select the Manual Override button.

The new status will be applied.

Fraud Monitoring Risk Score

The fraud monitoring risk score for the entity will be displayed on the lower part of the Risk Score tab. The score is computed as the highest risk level across all the transactions that were scored.

This will list all factors that contributed to the overall risk score.

Important Note: Fraud check Override behavior

When a fraud check during onboarding encounters an issue, the entity status cannot be overridden. While users can manually adjust the overall risk level (such as setting it to LOW), this does not allow the entity to pass. Instead, the entity's status will transition to Manually Failed.

Updated 13 days ago