Overview

Monitor customer activity for fraud and AML risk.

What are FrankieOne's fraud solutions?

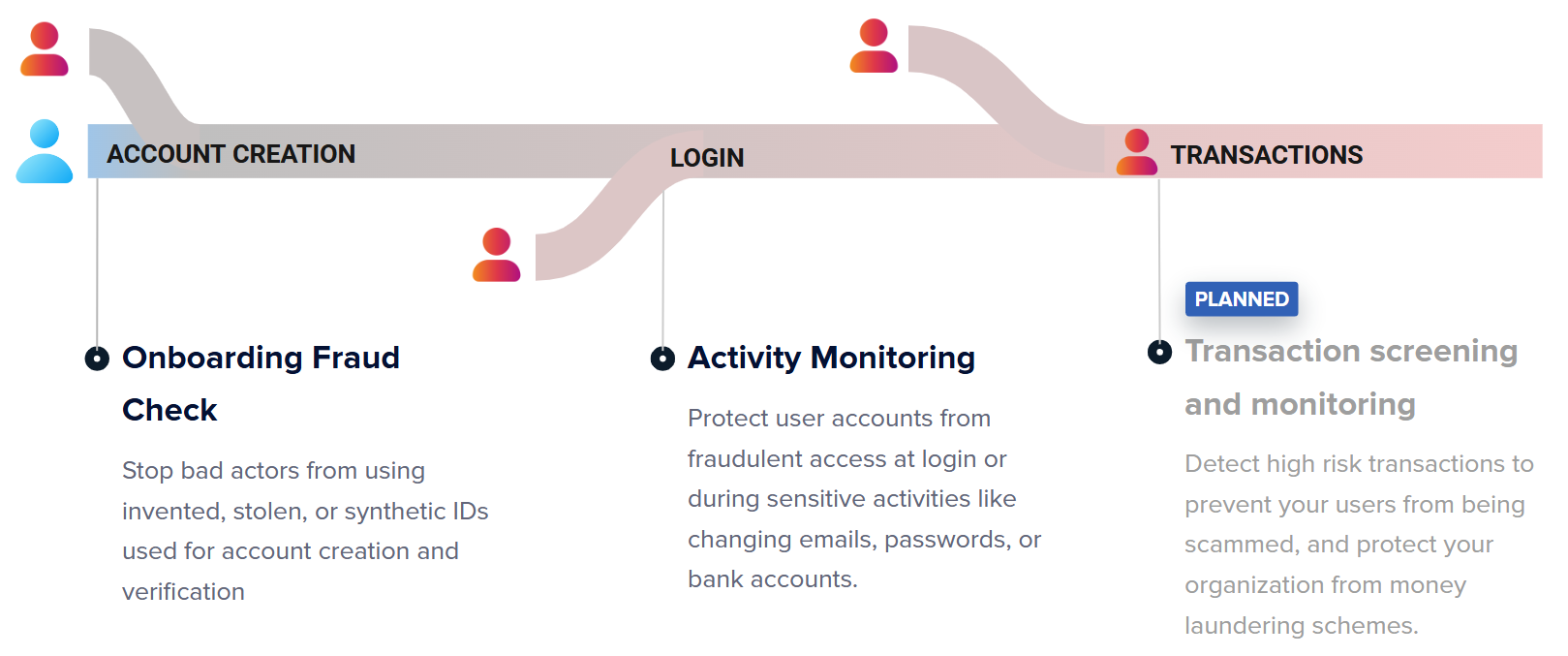

FrankieOne fraud solutions allow you to evaluate your users' fraud risk alongside their compliance risk across their user lifecycle. FrankieOne offers two main solutions:

- Onboarding Fraud Check which verifies the risk of your user's email, phone, and device at the point of Onboarding.

- Activity Monitoring which verifies the risk of your user's email, phone, and device at login or other high-risk activities like changing emails, passwords, or bank information.

Why use FrankieOne?

FrankieOne’s Fraud offering allows you to complement your KYC and KYB process during onboarding or ongoing activities to prevent bad actors from being onboarded or taking over legitimate user accounts. We help you grow your business safely by:

- connecting to the best-in-class fraud prevention tools,

- advising on your risk rules to help you balance fraud protection from bad actors with the conversion of good users, and

- staying compliant with AML regulations, and reducing your risk of fraud and money laundering by detecting suspicious activity.

Get started with FrankieOne Fraud Solutions

Use Cases

Onboarding Fraud Checks

Problem

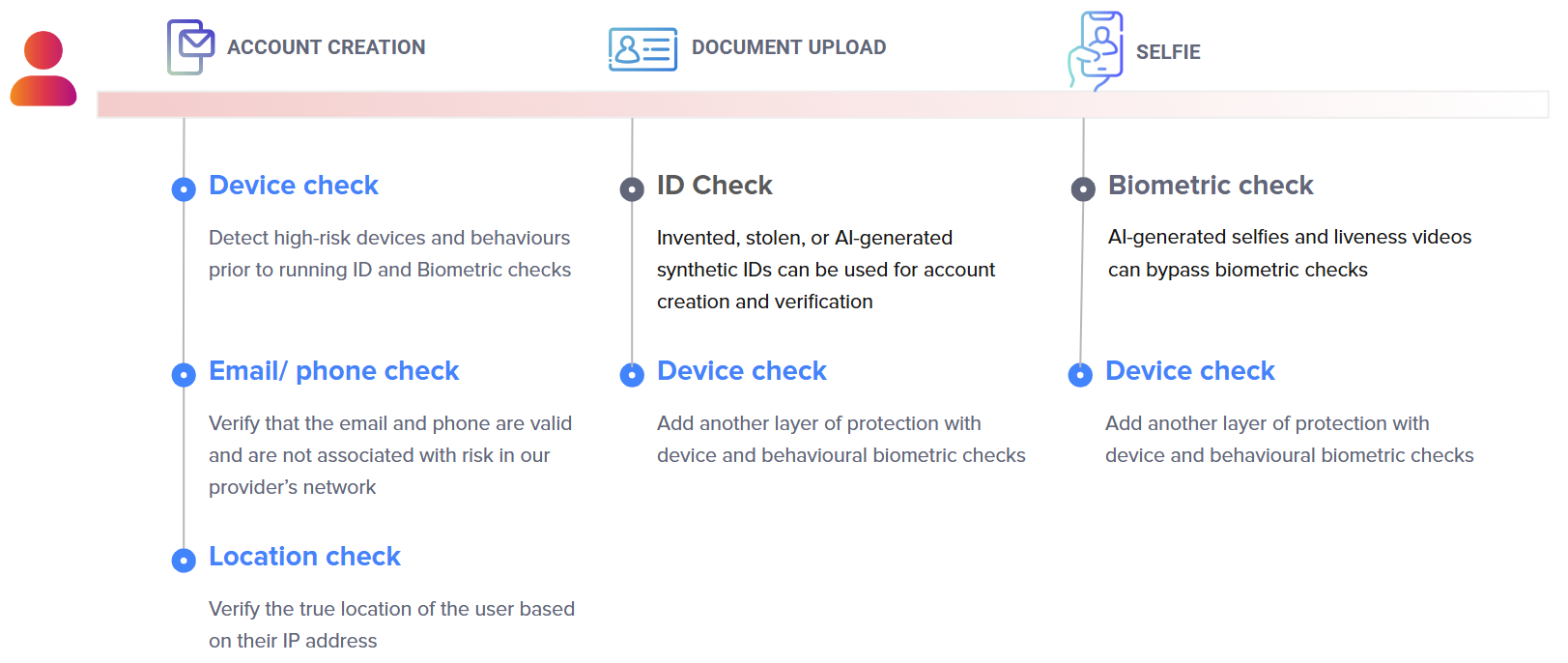

An increase in data leaks, phishing, and the rise of AI has empowered bad actors to create fake and synthetic identities that run the risk of passing document and biometric checks during onboarding. This puts your organisation at risk of financial loss and compliance risk, as illegitimate users create accounts, take advantage of promotions, or transfer funds through your application.

Solution

Onboarding Fraud Checks add an important additional layer of protection to your document and biometric verification, for a full fraud prevention solution. During the account creation process, customers can run the following checks to assess the risk of the user before they allow them to create an account with them:

- Email check

- Phone check

- Device check

- Location check

When high-risk signals are received, you can choose to block the entity from onboarding or only flag it for manual review.

Activity Monitoring

Problem

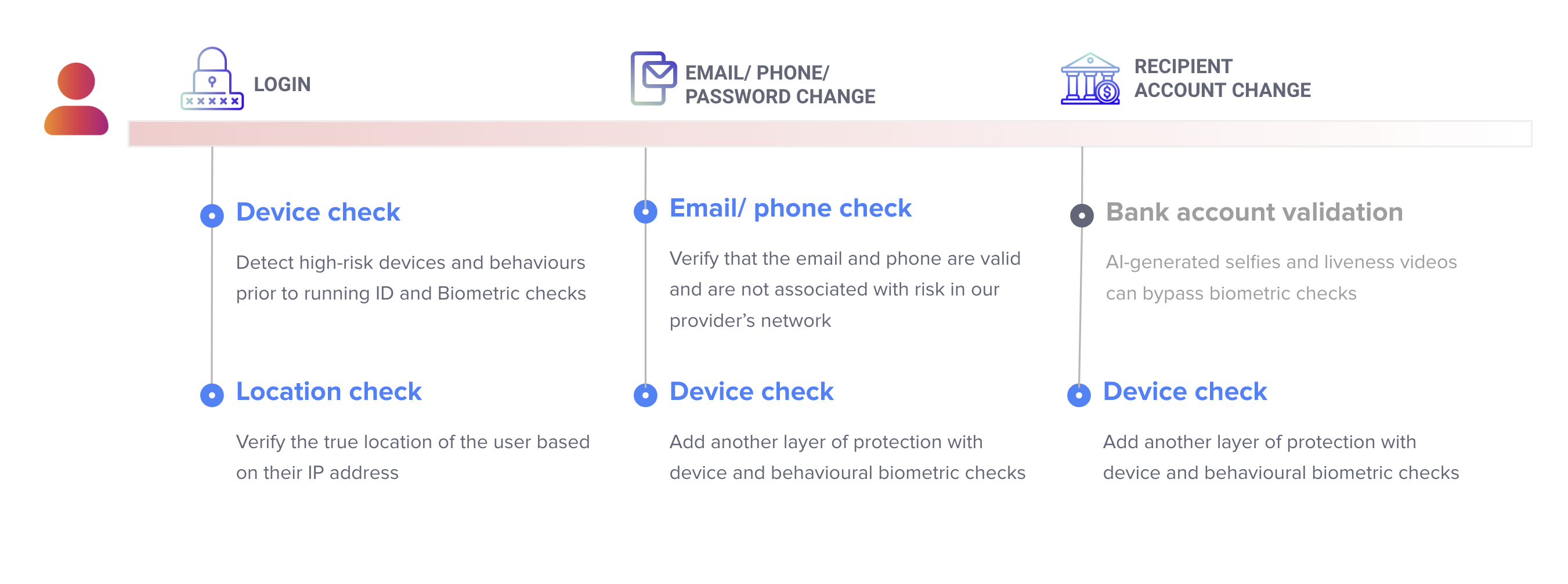

Account takeovers are one of the biggest monetary fraud risks to businesses. An increase in login credentials being leaked, and manipulation via social engineering is allowing unauthorized to take over legitimate accounts, change email, phone, and password credentials, and steal funds.

Solution

Activity Monitoring allows you to detect and prevent account takeovers, and high-risk or unusual sessions using the following checks: Email check, Phone check, Device check, and Location check.

When you receive high-risk results, you can choose to block or require more information to complete activities like logins, password changes, bank account changes, address changes, or high-value transactions.

Updated 15 days ago